Table of Content

The average closing costs in the United States, if you include taxes, are $6,905, up from $5,749 in 2020. The average closing costs in the United States total $6,905, including taxes. It actually refers to the extra fees you might pay to “buy down” your rate. Discount points add to your closing costs but reduce your interest rate. Closing cost assistance is available from state housing finance agencies and some local governments, lenders, and nonprofits. This typically comes in the form of down payment assistance, which can be used to help pay for your down payment and/or closing costs.

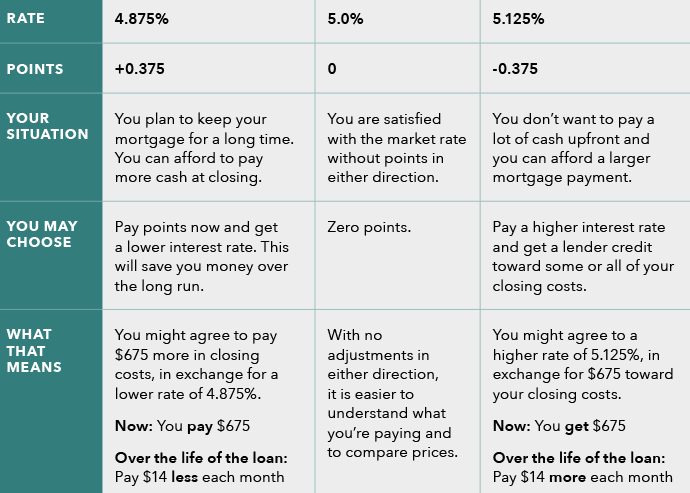

If it is charged separately, it can range between $400 and $900. A transfer tax is a one-time tax or fee imposed by a state, county or local government whenever a property changes hands. It may be a flat fee or a percentage of the home price, and the cost can vary significantly by location. When locking your interest rate with your lender, you have the option to buy down the rate. To do this, you pay “points” — essentially, paying interest in advance.

Save $20

Closing costs on a home can be significant for the buyer and seller. Closing costs can add up to between 2% and 5% for the buyer and 6% and 10% for the seller. With rebate pricing, on the other hand, you save $2,500 at the closing table. But you pay $36 more per month thanks to the higher interest rate. Rebate pricing is ideal for those who only plan to stay in the home or mortgage for a few years.

But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. It’s equally important to compare upfront fees and find the lender that’s most affordable overall — not just the one with the lowest rates. With a little time and dedication, it’s possible to get mortgage lenders to compete for your business. There are a number of ways to reduce your upfront closing fees.

Typical Closing Costs for Buyers

Along with transfer taxes and transfer feeds, property taxes must also be up to date for sellers before they hand over keys to the buyer. While buyers also pay closing costs (here’s more info on typical closing costs for buyers), you’ll see a long column on the HUD-1 Settlement Statement for seller closing costs. You may be estimating that your sale price could be $350,000, which could pay off your $200,000 home loan and reap you a $150,000 profit.

For sellers, closing costs can add up to 8–10% of the home sale price — on top of repaying any debts or liens related to a property. If you’re selling your home in an area where competition for property is slow, you might need to take extra steps to seal your home sale. This might mean offering your buyer some money to cover their portion of the closing costs. If closing credits, also referred to as seller concessions, were part of your sale agreement, you’ll need to pay for them at closing.

Estimate your closing costs

These fees are paid to the lawyer who manages the closing for the lender. You'll have to pay interest for the time between when your first payment starts and you close on the mortgage. This fee covers the lender's costs of underwriting and preparing your mortgage. Many or all of the offers on this site are from companies from which Insider receives compensation .

Rather than viewing concessions as an extra expense, think of them as bargaining chips to negotiate a higher selling price with the buyer. The best — and easiest — way to keep more cash in your pocket at the closing table is to sell your house with a low commission realtor. Real estate attorneys often charge a flat fee per transaction ranging from $800 to $1,500. Once the closing disclosure has been signed, it cannot be changed. Buyers must compare the closing disclosure with the initial loan estimate to identify any discrepancies.

Home sale transaction math

The costs won’t be final if changes are made after reviewing this document. Scheduling the closing date for the end of the month can result in lower closing costs. It might sound too easy, but there’s a reason behind this strategy. You must pay daily interest from the day of your closing to the last day of the month. So, if you close on Sept. 2, you’ll end up paying nearly a month’s worth of interest.

Did you know that your existing homeowners insurance policy may not cover your property when it’s vacant? If your home is going to be vacant for any period of time, it’s important to talk to your agent about adding a rider to cover that period. If instead of loaning someone is gifting you funds for your down payment or closing costs you will have to provide a letter stating the same.

If you find an escrow service that saves 20% on the escrow fees, that ends up saving you around 0.1% of the purchase price of the home, or $300 on a $300,000 home. Since realtor fees take such a huge chunk out of your sale proceeds, shopping around for a lower commission rate could lower your closing cost bill by thousands of dollars. Here’s how much you could expect to owe in seller closing costs, depending on what your home sells for. Houzeo’s Closing Cost Calculator is frequently calibrated to give sellers and buyers the closest estimate according to market conditions. A recording fee is paid to the local government to register the change in ownership of a house or sale of a property in the public record. So, for instance, if you purchase a house on the 4th of June, your first mortgage payment will be due on the 1st of August.

Selling a house is time consuming and expensive — often much more than sellers might expect. A tax monitoring fee is paid to a tax service agency that monitors if you are paying the property tax on time. The tax service agency will alert the lender in case you default. Lenders may require you to pay one year’s worth of property tax in advance at closing.

With an FHA loan, there is an upfront mortgage insurance premium, plus a monthly MIP fee for the life of the loan unless you make a down payment of 10% or more. USDA loans have an upfront guarantee fee and an annual guarantee fee that function similarly to PMI/MIP. While this is general advice, Rocket Mortgage® doesn’t offer USDA loans at this time. These are the states with no real estate transfer taxes, which should result in lower closing costs. If you're buying a home and not refinancing, the seller might be willing to cover part or all of your closing costs. If the seller pays them, it's called a "seller concession" or a "seller credit," and you might have to pay more for the house to make up for it.

The VA fee you have to pay depends on the down payment they make for a property. If you make a down payment of less than 5%, you have to pay a VA fee of 2.3% for your first home and 3.6% on any subsequent homes. Underwriting fee is a one-time fee charged by mortgage underwriters to evaluate and verify loan applications. Some lenders charge it in place of the originating fee, while others charge it in addition to the same.

Your lender might ask you to pay any interest that accrues on your loan between closing and the date of your first mortgage payment upfront. The amount of interest you’ll accrue depends on your loan amount and interest rate as well as your closing date. Ou’re required to get a pest inspection before you close on your loan. Pest inspections are also sometimes required if you’re buying a home with a VA loan. It may be required for other loans as well if the appraiser thinks there is a problem. Homeowners insurance is a type of protection that compensates you if your home gets damaged.

No comments:

Post a Comment